Recessions—technically defined as two or more consecutive quarters of declining GDP—make investors nervous for good reason. They are often accompanied by worsening labor market conditions which can affect consumer sentiment, our household finances and ability to spend. But for those with a long investment time horizon and the ability to withstand fluctuations in their account values, recessions may present opportunities to invest in securities at favorable prices.

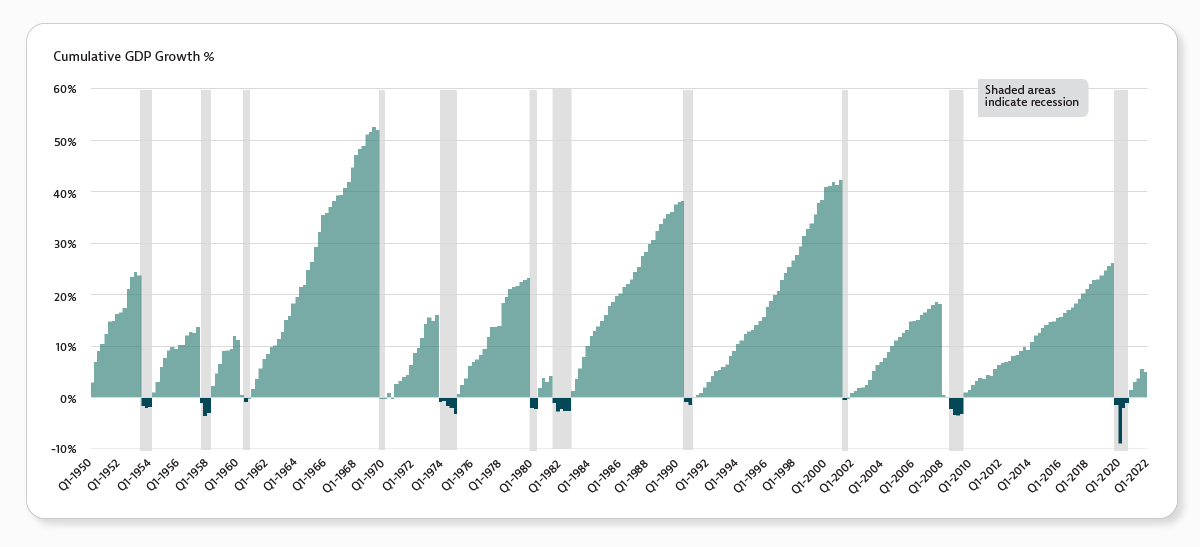

- Economic cycles are cyclical. From 1950 through the first quarter of 2022, there have been 11 recessions, each followed by a recovery.

- Recessions vary in severity and duration. For example, the 2008/2009 recession was triggered by a credit crisis, and it took the economy and markets a long time to recover. The 2020 recession sparked by the COVID-19 pandemic was relatively short-lived.

- Recessions and geopolitical tensions can trigger heightened volatility but may also present pockets of opportunity. A broad sell off may mean that some investments are undervalued.

- Some companies and sectors are more resilient to downturns in the economy and may fare better than stock indices in general.

Regardless of the economic backdrop, the investment professionals at the helm of Homestead Advisers-managed funds diligently look for opportunities to invest fund assets in attractively priced securities. In a recession, valuations for some securities could reach compelling levels.

Economic Recoveries Can Be Powerful

The chart below measures the quarter-on-quarter growth rate for GDP—the percent change from one quarter to the next—and is a way to identify turning points in the economy over time.

Source: Federal Reserve Economic Data. A recession is defined as at least two consecutive quarters of declining GDP.