Are there manageable ways for a cooperative to do more to support the financial health of their team?

The Challenge

Lake Region Electric Cooperative (LREC) is an important employer within its community and, like many employers, is concerned about recent research showing a dramatic rise in economic insecurity.

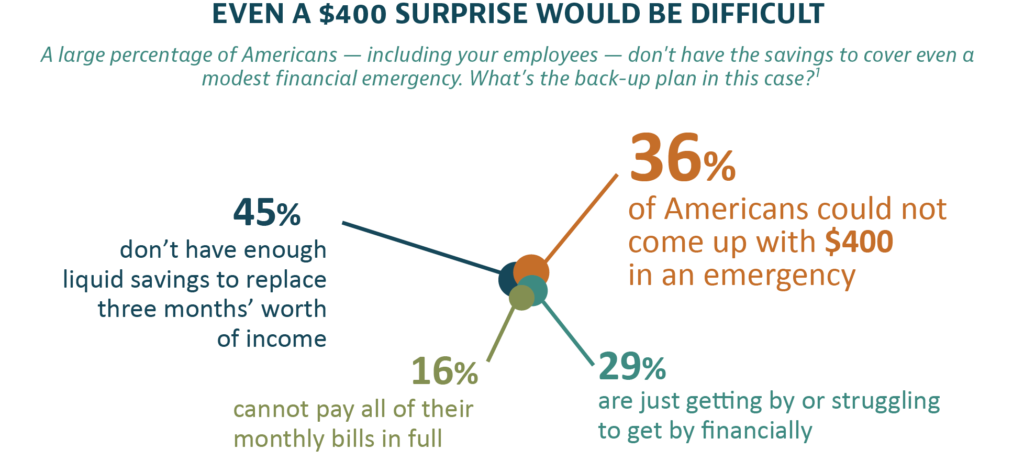

According to a 2020 Willis Towers Watson survey of 464 U.S. employers, 34% of respondents indicated they were currently experiencing workforce challenges as a result of employees’ short-term financial stress. That is up 26% from 2017 survey findings.

“Homestead knew just how to help us. They were very easy to work with and made our idea a reality. The employee savings program is a nice benefit for our employees, and it’s helped them to reach their personal savings goals.”

— Tim Thompson, CEO, Lake Region Electric

The Partnership

It turns out that LREC is not alone with this question. Employers recognize employees who have trouble covering their day-to-day expenses are less likely to contribute to their 401(k)s. According to the Wall Street Journal, employers are increasingly taking steps to add emergency savings accounts, often matching contributions, as a way to attract and retain talent. But how could LREC set up a plan and make it work?

Homestead Funds offers financial expertise and an understanding of cooperative financial structures. Homestead also provides educational resources and onsite employee meetings that allow for one-on-one engagement to assist employees with their savings questions.

By tapping into that experience, LREC came up with a framework to encourage employee savings. Homestead worked closely with LREC’s CEO and HR personnel to clearly understand their goals and budget, and the needs of their employees. Together, Homestead and LREC developed a savings campaign for LREC’s employees.

The Solution

Working with Homestead, LRECA offered employees investment choices that went beyond bank savings accounts and CDs.

- Homestead’s mutual funds offered a way for employees to invest in line with their goals, balancing objectives for safety of principal and growth.

- Assets are held in accounts owned by the employee, so they can continue to fund or access their money whenever the need arises.

The Results

The program was an immediate hit, with more than 2/3 of employees signing up in the first three months.

1The Federal Reserve, Report on the Economic Well-Being of U.S. Households in 2020. Published May 2021.

This case study is for illustrative purposes only and is not meant to guarantee that any individual’s needs or objectives will be met. This case study should not be construed as a testimonial. Other clients may not have received the same or similar results.

Employer-Sponsored Savings Program

Partner With Us