Russia’s invasion of Ukraine is a humanitarian tragedy that has caused loss of life, forced migration and wide-spread destruction of infrastructure. Understandably, the conflict is also spooking investors, who are wondering if this combination of global uncertainty, higher interest rates and rising energy prices should prompt them to seek the shelter of less volatile assets.

We wanted to share our thinking regarding some of the questions and concerns we have been hearing from investors.

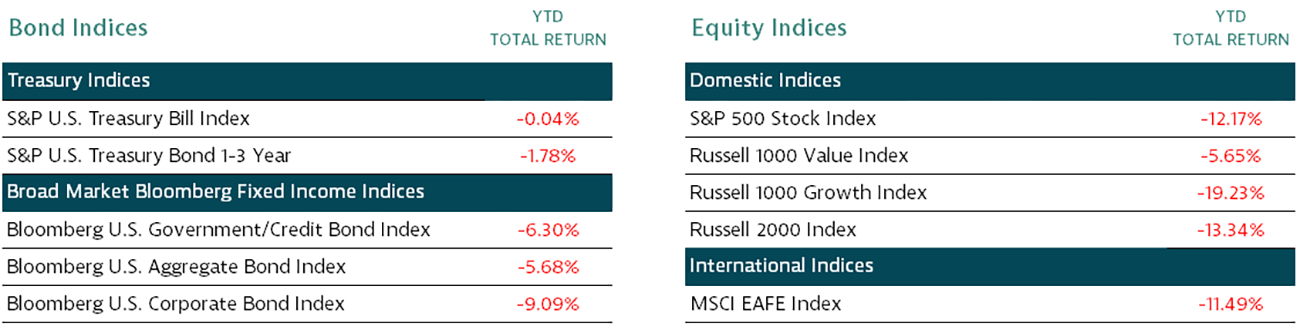

Most major stock and bond indexes are down year-to-date through March 14, 2022. Shouldn’t bonds have provided a cushion?

In 2021, both stocks and bonds benefited from strong tailwinds. Stocks were powered by strong consumer balance sheets and pent-up demand for goods and services as the country emerged from the pandemic. While yields on fixed-income securities were uninspiring, bonds benefited from a continuation of the Federal Reserve’s ultra-accommodative monetary policy and low levels of inflation. Those tailwinds are now moderating, as we see signs of higher inflation and sharply rising energy prices. This shifts the Fed’s focus to tamping down inflation, which typically means rising rates.

Whether bonds helped cushion the blow for your portfolio depends on which segment of the bond market you invested in. Historically, prices of shorter-term, high-quality bonds decline less in response to a rise in rates than longer term bonds issued by less-creditworthy entities. So far in Q1, returns for most bond indices are in negative territory, but they are generally down far less than stocks. And the more conservative segments of the bond universe performed as expected and declined far less than the more aggressive types.

Aren’t rising rates bad for both stocks and bonds?

It’s not that simple. For bonds, as rates rise prices decline. That’s true. But investors benefit as proceeds from maturing securities are used to purchase bonds with higher coupons. That means more interest income.

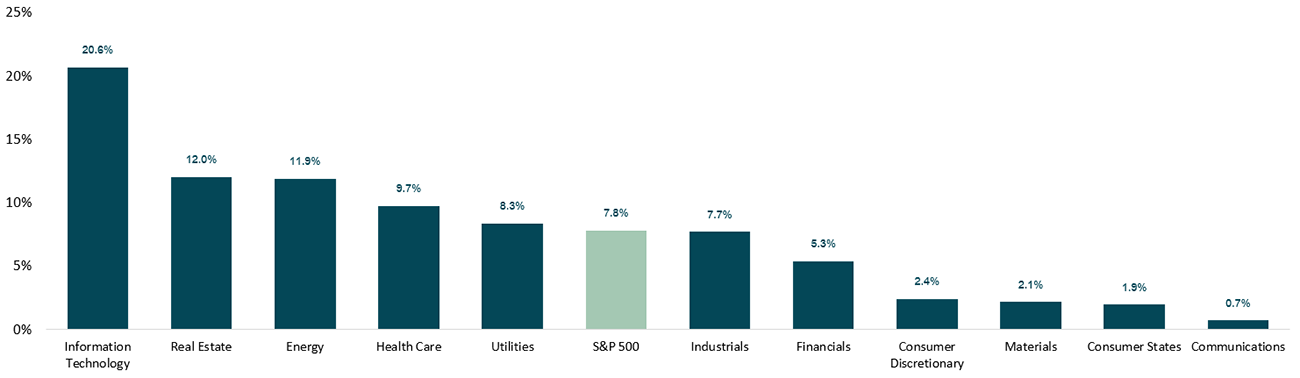

For stocks, rising rates mean higher borrowing costs for companies, which can slow their growth. But as you can see in the chart below, cycles of rising rates aren’t universally negative for performance.

For Stocks, the Impact of Rising Rates Has Varied by Sector

Average Sector Performance During Periods of An Increasing Fed Funds Target Rate (Annualized)

Source: Strategas. Past performance is no guarantee of future results. The analysis examines the 1994, 1999, 2004 and 2015 tightening cycles. The Standard & Poor’s 500 Stock Index is a broad-based measure of U.S. stock market performance and includes 500 widely held common stocks. Indices are unmanaged, and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns include reinvested dividends. The federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their excess reserves to each other overnight.

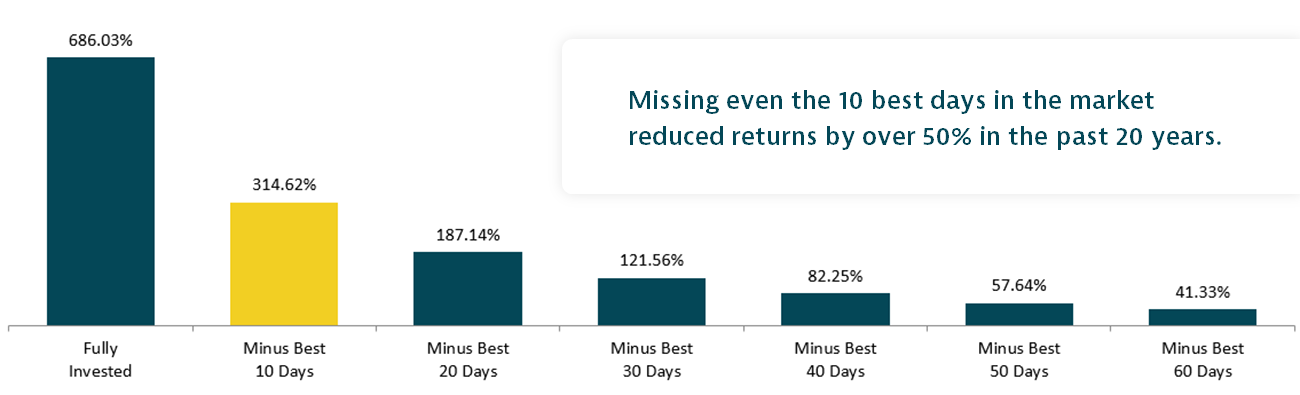

What if things get worse before they get better? Would I be wise to move my assets to cash temporarily?

A flight to safety is not risk-free. Even if you’re lucky enough to avoid a dip, you might not be lucky enough to get back in before a rebound. And you need to be in the market to benefit from any potential recovery. The graph below shows the cumulative stock market returns with and without the best days in the market.

Depending on your account type, there may also be tax consequences. Inflation is another consideration. Cash will hold its value, but the purchasing power of every dollar declines as prices for goods and services rise. So you are effectively losing money.

Chart shows the cumulative total returns, which includes the reinvestment of dividends and capital gains, for the S&P 500 Stock Index for the period January 2, 2002, through December 31, 2022, and cumulative returns for that same time period minus best days as measured by historical price data. This chart is for educational purposes only to demonstrate the effects of market timing. It is not a promise of any investment’s future returns. Past performance does not guarantee future results.

My portfolio is heavily allocated to stocks and that makes me nervous.

Your investment approach should always be based on your needs, time horizon and risk tolerance, not the events of the day. Try to take a break from the news cycle if it’s sparking anxiety. And consider booking a meeting to speak with us about your portfolio allocations.

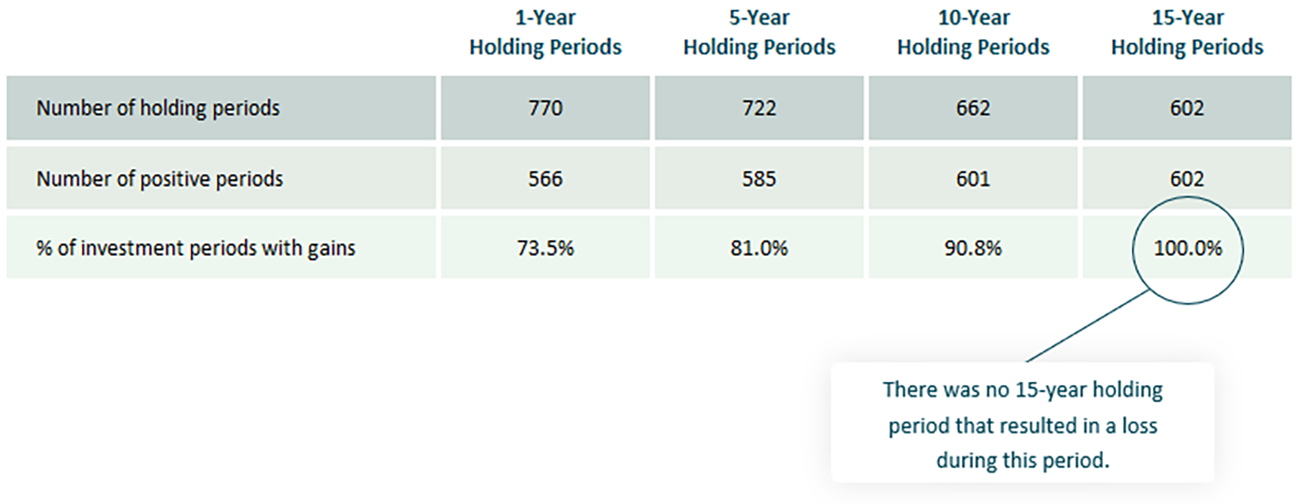

Stocks tend to be more volatile than other asset categories, but history shows the chance of incurring a loss declines the longer you remain invested. This analysis divides the last 65 years of returns for the S&P 500 Stock Index into holding periods of various durations. As you can see, there was no 15-year holding period that resulted in a loss during this time period.

Chart shows the number and percentage of rolling investment periods with positive returns based on historical monthly returns for the S&P 500 Stock Index for the period December 30, 1956 through December 31, 2021.

Let’s talk. We can help you assess your investment objectives and current portfolio allocations. If changes are in order, we can discuss ways to fine tune that don’t disrupt your long-term plan or expose you to market-timing risk.

Contact Us

Related Resources

Homestead Funds does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Neither asset allocation nor diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.