When senior leaders at a cooperative want to save as much as possible for retirement, can a nonqualified deferred compensation plan provide an option? Let’s look at one potential scenario that co-ops could encounter.

The Challenge

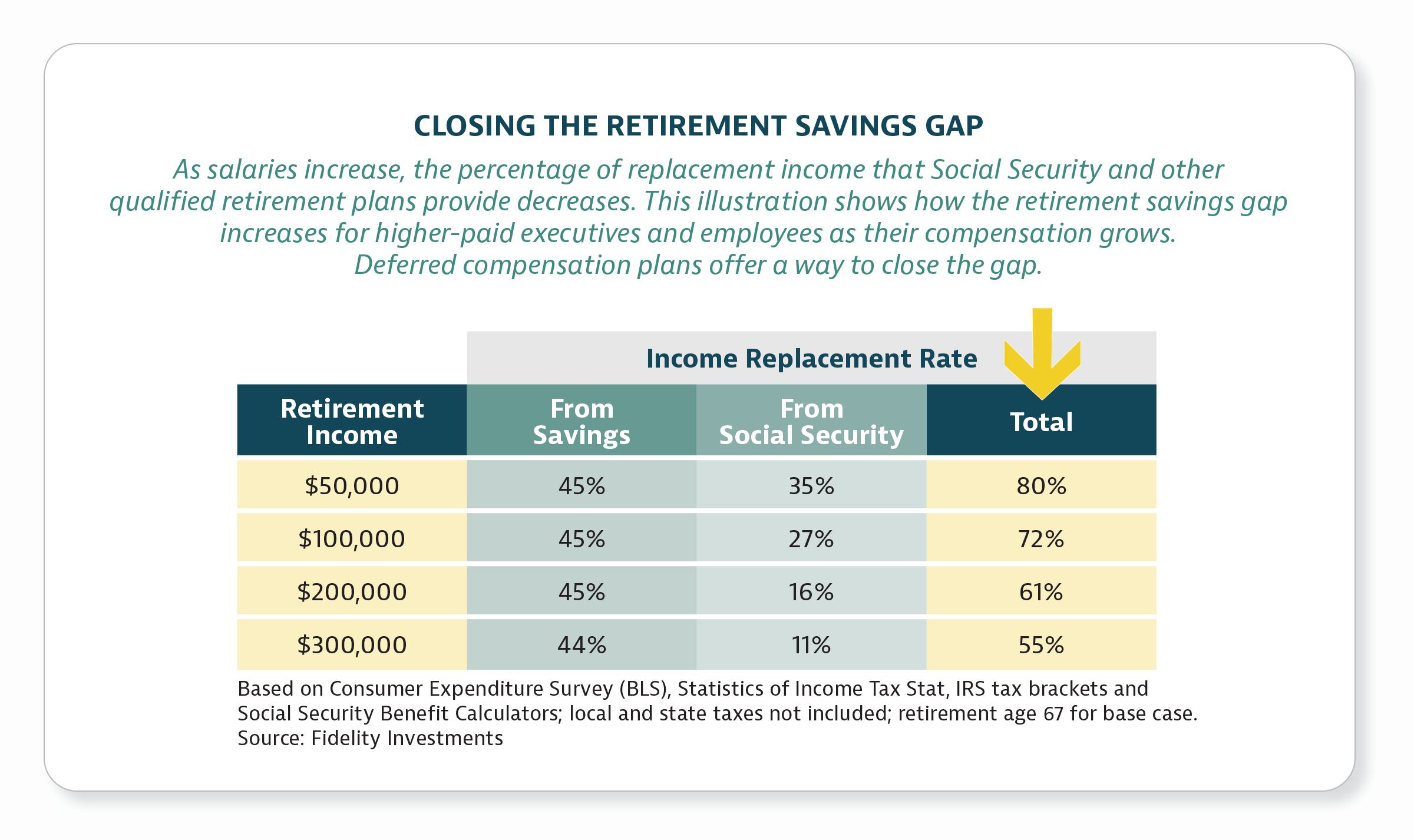

With senior managers approaching retirement, Anytown Cooperative,* a distribution co-op with 75 employees, needs to have a competitive benefits package to attract quality candidates. Current retirement plan options, including a defined benefit plan and a 401(k) plan with a company match, provide a competitive edge for hiring and retaining entry-level and middle management employees. However, Anytown is concerned they may have a “gap” in their compensation offerings for the C-suite employees.

In Anytown Cooperative’s 401(k) plan, higher-income employees are not able to maximize their employee contributions due to nondiscrimination testing. In addition, C-suite employees who earn more than the IRS maximum amount for qualified retirement plan purposes are not able to receive the matching contribution on the portion of their compensation over the IRS limit.

One fix for the nondiscrimination testing issue would have been to modify the co-op’s 401(k) plan to comply with the “safe harbor” requirements of ERISA (Employee Retirement Income Security Act) by offering a fully vested employer contribution for all or an enhanced matching contribution. However, since the enhanced match would have been applied to all employees’ W-2 income, the potential cost of such a plan would be prohibitive (considering Anytown allows significant overtime hours for customer service and line workers during weather events) and the problem of the match for executives over the IRS salary limit would have been left unresolved.

“In a very competitive hiring climate, we realized we might need more tools to attract and retain key executives. Homestead’s Deferred Compensation team helped us to design a set of plans tailored to our co-op’s specific needs.”

— Amy W. Rouse, CPA

Executive Vice President, Corporate Services

Jackson EMC

The Partnership

Homestead Funds’ Deferred Compensation team can look at possible options to allow Anytown’s executive team to save more on a tax-deferred basis. Homestead Funds’ Deferred Compensation team can offer solutions that allow Anytown to contribute the executives’ restricted 401(k) match as well as offer additional deferral savings options.

The Solution

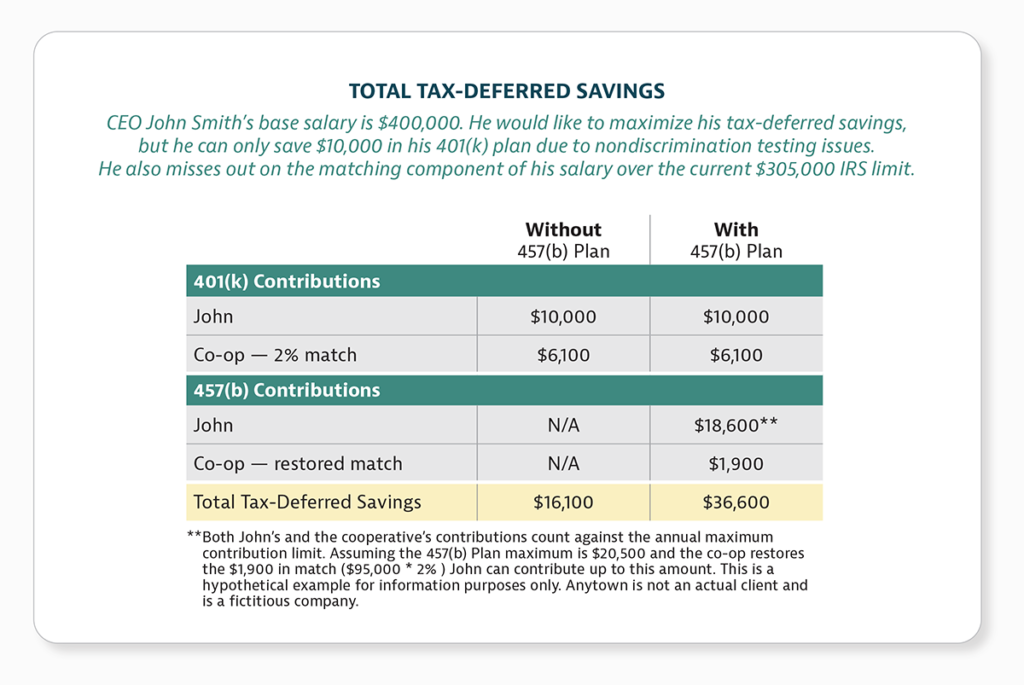

Anytown could establish an Executive Compensation 457(b) Plan for Employees.

- The plan, limited to a select group of managers, would allow participants to save up to $20,500 (2022 limits) on top of the amount they are eligible to contribute to their 401(k) plan.

- The plan would allow for employer contributions, including (but not limited to) the restored matching contributions.

- Costs would be limited to a plan establishment fee of $550, the cost of the restored contributions for the impacted employees, plus an ongoing annual administrative fee of up to $1,000.

While these plans provide for immediate vesting, all assets in the plan are owned by the cooperative until funds are distributed to the participants after separation. In the event of a cooperative bankruptcy or financial distress, plan assets are subject to claims by general creditors.

The Results

By offering the Executive Compensation 457(b) Plan for Employees, Anytown leaders would now have a more competitive package to offer new and existing senior executives.

This would allow Anytown to establish individual accounts (owned by the co-op) for each eligible participant. Funds would be deferred into these accounts through the payroll system (like 401[k] contributions), and participants would be able to manage their investments using Homestead’s online platform. The participants could also take advantage of asset allocation and retirement planning guidance from one of Homestead’s financial professionals.

*This hypothetical case study is for illustrative purposes only and is not meant to guarantee that any individual’s needs or objectives will be met. This example should not be construed as a testimonial.

Neither asset allocation nor diversification guarantees a profit or protects against a loss in a declining market. They are methods used to help manage investment risk.

Homestead offers nonqualified deferred compensation plans as an additional service to members for their employees and directors and provides certain administrative support services; however, Homestead does not sponsor or act as the plan administrator of these plans, assume liability for their operation, or provide legal or tax advice in conjunction with the plans. Employers and participants are responsible for any tax or legal consequences associated with their adoption, operation or participation in nonqualified deferred compensation plans.

Deferred Compensation

Partner With Us