When severe weather poses a threat to an electric cooperative, can a mutual fund company step in to help?

The Challenge

Situated in Virginia’s Chesapeake Bay region, Northern Neck Electric Cooperative is surrounded by history and pristine water views. The beauty in this area is remarkable — and so is its weather.

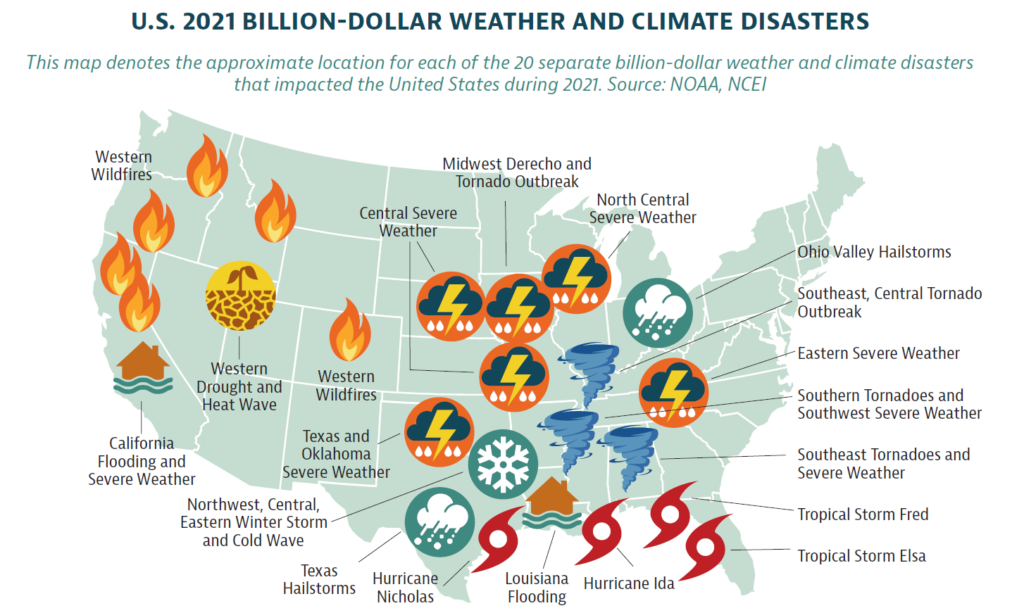

Violent thunderstorms, tornadoes, hurricanes and winter storms impact Virginia on a regular basis. As natural disasters occur, co-ops like Northern Neck Electric Cooperative must anticipate the devastation and potential power outages they bring.

As Northern Neck discovered, when cooperatives don’t have cash on hand to deal with emergencies or other large capital outlays, their financing options aren’t always ideal. FEMA grants become bottlenecks, and loans can turn into costly, long-term liabilities.

“Over the years Northern Neck has developed an extensive plan to restore power to our members in a timely and efficient manner after major weather events. Establishing this reserve account with Homestead helps ensure that we can carry out that plan without an impact on the financial integrity of the cooperative.”

— Greg White, Retired President & CEO, Northern Neck Electric Cooperative

The Partnership

Northern Neck approached Homestead Funds with the idea of establishing a reserve fund that it could build over time and tap into when needed. Northern Neck chose Homestead because it has a long history of working with cooperatives. Homestead shared ideas of how other cooperatives have used low-cost, moderate-risk investments in Homestead Funds to establish reserves for emergencies, equipment purchases and many other large-scale spends.

Together, Homestead and Northern Neck developed a solution that took advantage of each partner’s strengths. By allocating across a mix of Homestead Funds, Northern Neck established a diversified portfolio that meets their needs for liquidity while providing the potential for long-term asset growth. So when storms wreak havoc in the area, the co-op can respond quickly to customer needs while reducing the impact on its financial statement.

The Solution

Northern Neck established a corporate reserve account with Homestead Funds.

- Northern Neck identified the source of funding and determined how and when the money could be used.

- Homestead representatives provided guidance in establishing the mix of funds in the portfolio, using an approach that allows the co-op to benefit from market growth while meeting risk tolerance needs.

Today, Homestead continues to work with Northern Neck by providing performance metrics and regular check-ins that help ensure investment risk and liquidity needs are balanced as funds move in and out of the account.

The Results

With savings set aside, Northern Neck remains a reliable source of power for its customers — regardless of Mother Nature’s unpredictability.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

This case study is for illustrative purposes only and is not meant to guarantee that any individual’s needs or objectives will be met. This case study should not be construed as a testimonial. Other clients may not have received the same or similar results.

Storm Reserve Accounts

Partner With Us